Independent Difference

INDEPENDENCE MEANS GREATER FREEDOM FOR ALL

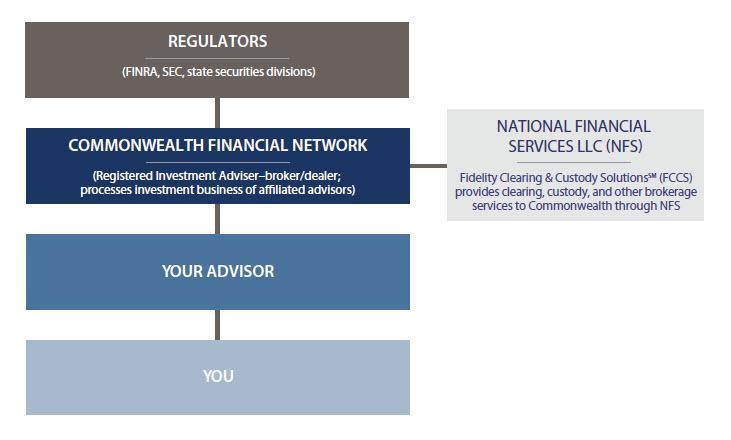

In the highly regulated securities industry, multiple federal and state entities provide oversight of the work financial advisors do on behalf of investors. The types of services an advisor provides carry a corresponding requirement to affiliate with an appropriate firm or entity to ensure compliance with the rules governing those services. But we have many choices of whom to affiliate with and which business model we want to follow. The fact that we’ve chosen to work with Commonwealth Financial Network®, a Registered Investment Adviser–broker/dealer, provides some key advantages to you:

- Our firm remains free to act in your best interest and to help you follow the best course of action to meet your financial goals. We can make recommendations to you without any pressure to promote proprietary products or strategies. It’s a model that differs from that of some other types of financial firms whose advisors are accountable not just to their clients, but also to the parent company that employs them.

- Because Commonwealth is independently owned and managed, the firm is able to allocate resources toward whatever is in the best interests of its financial advisors and their clients, not shareholders.

- Fidelity Clearing & Custody SolutionsSM (FCCS)1 provides clearing, custody, and other brokerage services to Commonwealth through National Financial Services LLC (NFS). Like Commonwealth, NFS is an industry leader with a long and stable history of customer service excellence. We have the utmost confidence in the proficiency with which NFS handles every trade, statement, report, and myriad other transactions for millions of clients—and we believe that you can as well.